A Comprehensive Analysis of Ready Signal’s Capabilities and Use Cases

This blog provides an in-depth exploration of Ready Signal’s advanced AI capabilities and its application in the plastic industry. By harnessing the power of data-driven insights, Ready Signal offers invaluable support to businesses seeking to optimize their operations, enhance decision-making processes, and capitalize on emerging opportunities within the plastic industry. This report delves into the various features and use cases of Ready Signal, highlighting its potential to revolutionize the way organizations in the plastic industry leverage data and gain a competitive edge.

Use Cases in the Plastic Industry

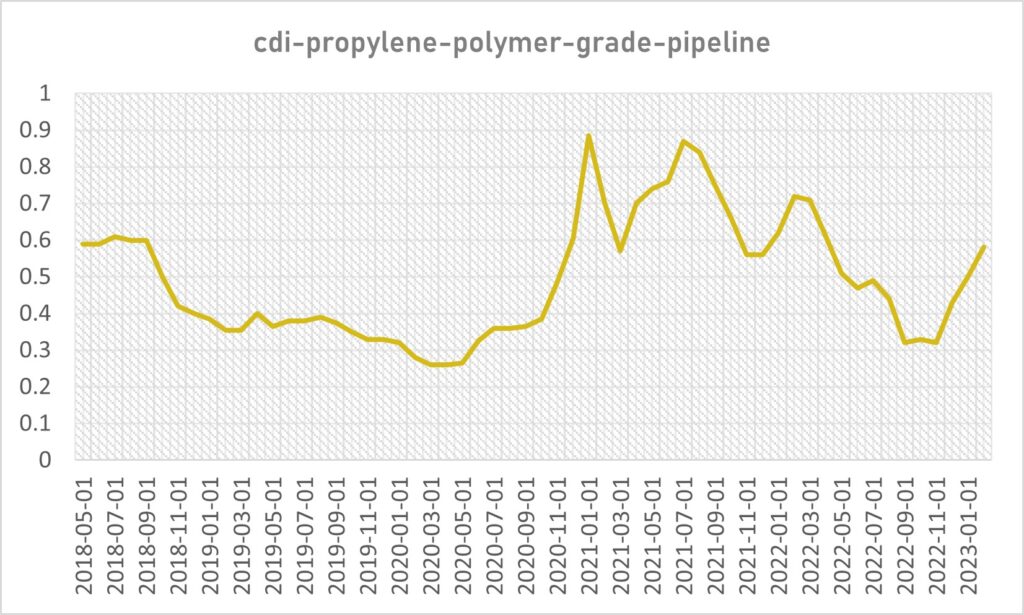

At Ready Signal, our journey toward uncovering influential factors in the plastic industry began with a simple yet powerful step: analyzing a time series of resin prices. The graph to the right vividly captures the fluctuations and trends observed in the CDI Propylene Polymer Grade Pipeline price series over time. With a focus on external variables, we aimed to unravel the underlying forces shaping the industry. By delving into this essential dataset and harnessing the capabilities of our AI recommendation engine, we embarked on a quest to discover the external insights that drive the plastic industry’s dynamics.

At Ready Signal, our journey toward uncovering influential factors in the plastic industry began with a simple yet powerful step: analyzing a time series of resin prices. The graph to the right vividly captures the fluctuations and trends observed in the CDI Propylene Polymer Grade Pipeline price series over time. With a focus on external variables, we aimed to unravel the underlying forces shaping the industry. By delving into this essential dataset and harnessing the capabilities of our AI recommendation engine, we embarked on a quest to discover the external insights that drive the plastic industry’s dynamics.

Correlation Output

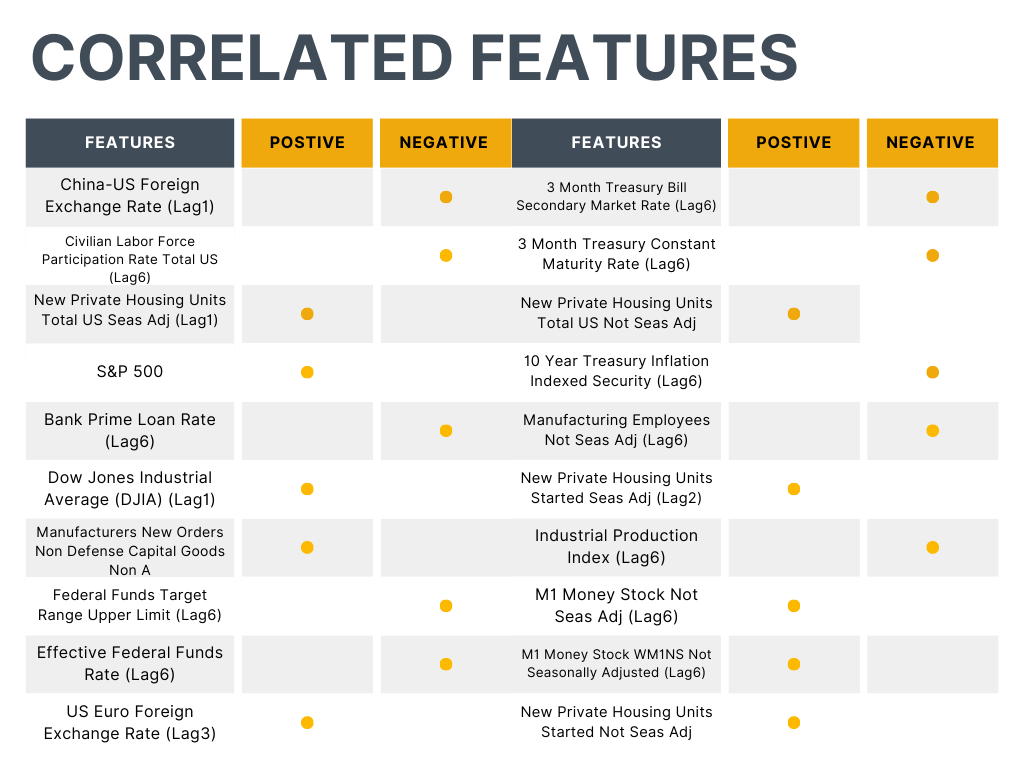

To isolate the external factors influencing the plastic industry, Ready Signal’s AI recommendation engine was deployed on a price series of CDI Propylene Polymer Grade Pipeline. By focusing solely on external factors, the analysis aimed to provide a clearer picture of the industry’s dynamics and the external variables impacting it. The AI recommendation engine autonomously explored and identified relevant data points, using correlation analysis to rank the features that exhibited the strongest relationships with the CDI Propylene Polymer Grade Pipeline price series. The partial output can be seen to the left. Further analysis and detailed results can be found on the following page.

Below is the price series of CDI Propylene Polymer Grade Pipeline USG Contract DEL USD/lb’s output from Ready Signal with correlated features by positive or negative correlation. Click here to see the full data catalog of what Ready Signal has to offer and for a closer look at what each feature is.

Negative correlations: The negative correlations with variables such as the 10 Year Treasury Inflation-Indexed Security, 3 Month Treasury Bill Secondary Market Rate, and Bank Prime Loan Rate suggest that changes in interest rates and borrowing costs can impact the value of CDI PP Pipeline. When these rates increase, it becomes more expensive for businesses to borrow money, potentially reducing their capacity to invest in propylene polymer-grade pipelines. Consequently, the value of the pipeline may decrease.

Positive correlations: The positive correlations with variables like China US Foreign Exchange Rate and Dow Jones Industrial Average indicate that global economic factors and stock market performance can influence the value of the pipeline. For instance, as the China US Foreign Exchange Rate increases, it suggests a strengthening of the Chinese economy relative to the US. This may result in increased demand for propylene polymer grade pipelines, thus raising their value. Similarly, a rise in the Dow Jones Industrial Average reflects overall market confidence and economic growth, which can positively impact the value of the pipeline.

These correlations highlight the interconnectedness of the CDI PP price series with various economic indicators. Understanding these relationships can help stakeholders in the plastic industry make more informed decisions. For example, monitoring interest rates and exchange rates can provide insights into potential changes in the value of the pipeline, enabling companies to adjust their pricing strategies and investment plans accordingly. Additionally, tracking stock market trends can help gauge market sentiment and anticipate shifts in demand for propylene polymer. By leveraging these correlations, industry players can proactively respond to market dynamics, optimize their operations, and maintain a competitive edge.

We didn’t stop at analyzing the price series of the CDI Propylene Polymer Grade Pipeline. At Ready Signal, we took it a step further by leveraging our automated forecast solution. This powerful tool utilizes advanced forecasting algorithms and machine learning techniques to predict future price movements in the plastic industry accurately. By feeding the price series into our forecast solution, we enable businesses to anticipate market trends, make informed decisions, and proactively adapt their strategies. Our automated forecast solution adds a predictive dimension to the insights derived from the analysis, empowering businesses in the plastic industry to stay ahead of the curve and optimize their operations.

Forecast Output

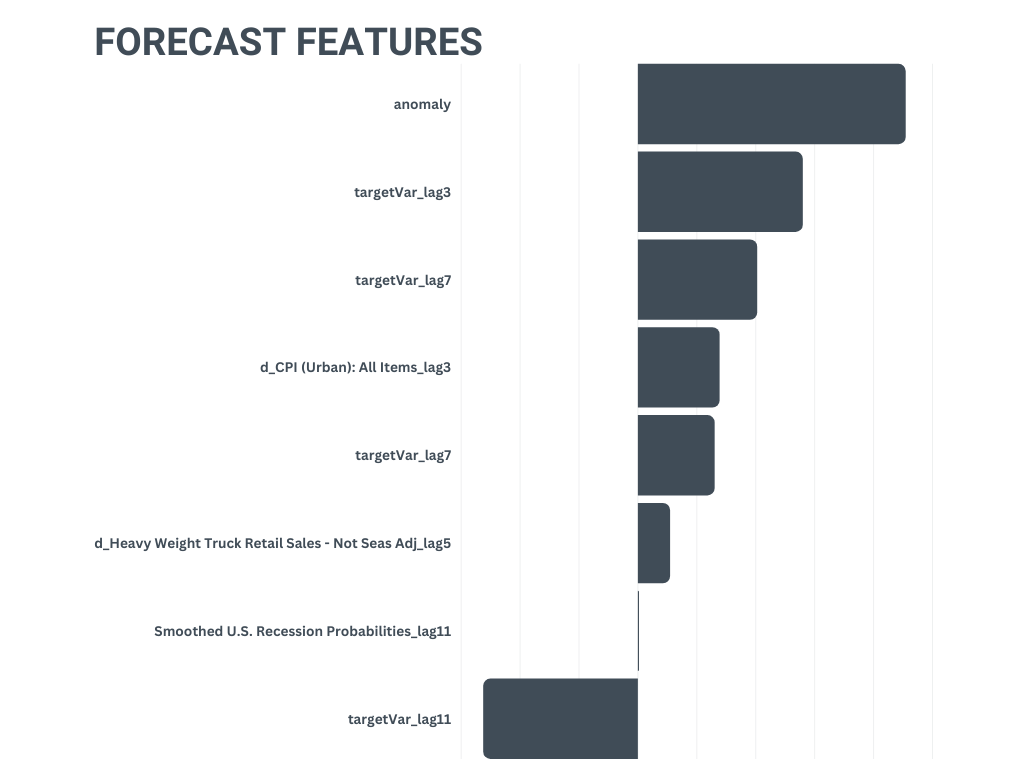

The analysis reveals several key insights for the plastic industry based on the forecast model. Firstly, the “CDI Propylene Polymer Price_lag3” feature indicates that past prices have a significant influence on today’s price, with a lag of 3,7 and 11 months being strong indicators. This suggests that understanding historical price trends and incorporating them into pricing strategies can be beneficial for the industry.

The “anomaly” feature captures the impact of exceptional events like the COVID-19 pandemic and supply chain disruptions. By considering these anomalies in pricing and supply chain management, the plastic industry can better adapt to unexpected shocks and mitigate their effects on operations.

Additionally, the “d_Supply of Houses in the US – Not Seas Adj_lag5” feature, which represents the differenced supply of houses, can offer valuable insights into the state of the housing market. Changes in housing supply can indicate shifts in demand for plastic-based construction materials, influencing production and sales strategies within the industry.

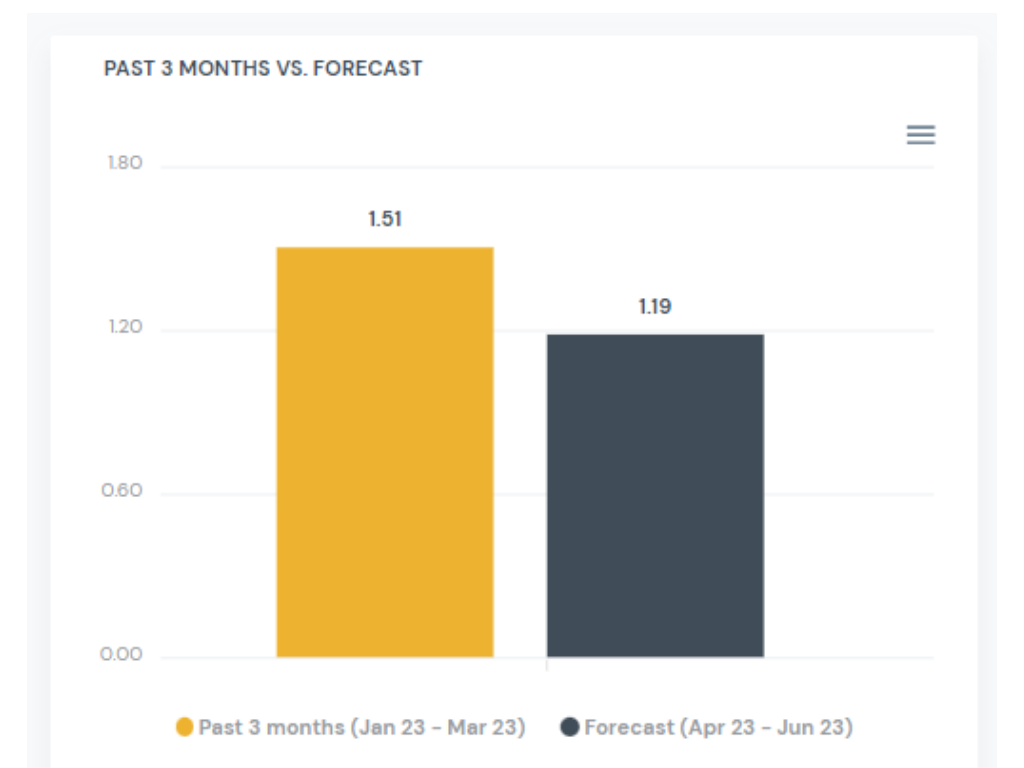

When considering the overall forecasts, it is suggested that prices in the plastic industry are gradually falling back to pre-pandemic levels and are expected to further decrease in the next three months. This indicates a trend of normalization in the market after the disruptions caused by the COVID-19 pandemic. By anticipating and preparing for this price decline, businesses in the plastic industry can adjust their pricing strategies and inventory management to align with the changing market conditions. Implementing cost-saving measures and exploring opportunities for efficiency gains can help mitigate the impact of declining prices and maintain profitability during this period.

Leveraging Insights for Operational Excellence

Leveraging historical price trends for pricing models, implementing anomaly detection mechanisms, adapting to housing market dynamics, and managing labor costs and raw material availability can collectively lead to operational excellence in the plastic industry. By implementing these strategies, companies can position themselves for long-term success, sustain competitiveness, and effectively navigate challenges in a dynamic business landscape.

How can the Plastic Industry Leverage Data?

In summary, it is important to note that the forecasts presented in this white paper were generated solely using external data, without the inclusion of internal variables such as sales or marketing data. However, it is evident that these forecasts can be further enhanced by incorporating internal data alongside the external factors analyzed. By leveraging both internal and external data sources, the plastic industry can unlock even greater forecasting accuracy and strategic insights.

Ready Signal’s AI engine offers invaluable insights and forecasting capabilities

By thoroughly analyzing external factors and their correlations with price series data, our engine uncovers crucial features that directly impact the plastic industry. These insights, including the influence of past prices, the effects of anomalies, and the significance of variables like housing supply, labor costs, and raw material prices, provide the guiding compass for informed decision-making and effective strategy formulation within the industry.

Ready Signal also offers unparalleled versatility

As a user-friendly platform, it seamlessly integrates with a wide range of data visualization tools, including Excel, DOMO, Tableau, and data warehouses. This flexibility allows businesses to harness the power of their existing analytics infrastructure and effortlessly access crucial insights in a matter of seconds. Whether you’re embarking on your analytics journey or seeking to enhance your forecasting capabilities, Ready Signal adapts to your specific needs.

Ready Signal’s offering is custom and tailored to your own organization and market

Imagine what Ready Signal can do for you, even with limited data. Our advanced analytics tool has the capability to transform your business by optimizing pricing strategies, navigating disruptions, aligning production with market demand, and effectively managing costs within the plastic industry. By leveraging the power of AI-driven insights, your company can gain a substantial competitive edge, improve operational efficiency, and drive sustainable growth in today’s dynamic market landscape.

If you’re ready to take the next step and are ready to leverage data in the plastic industry, we invite you to contact us today. Let us show you firsthand what Ready Signal can do for your business. We invite you to reach out to us via social media or our website for a personalized demo.